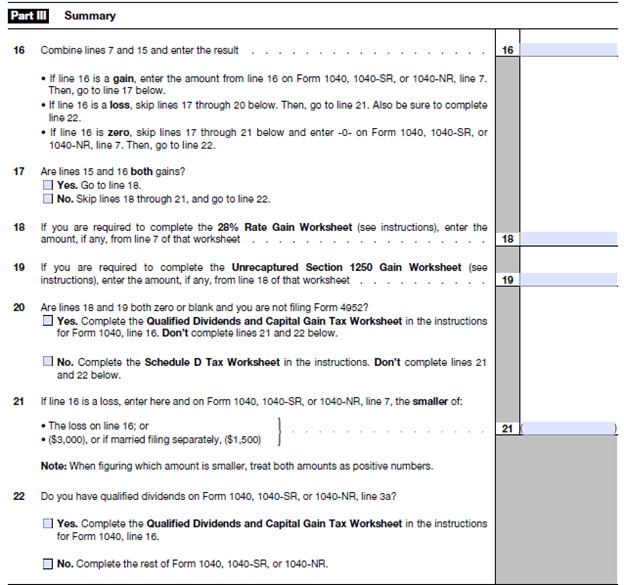

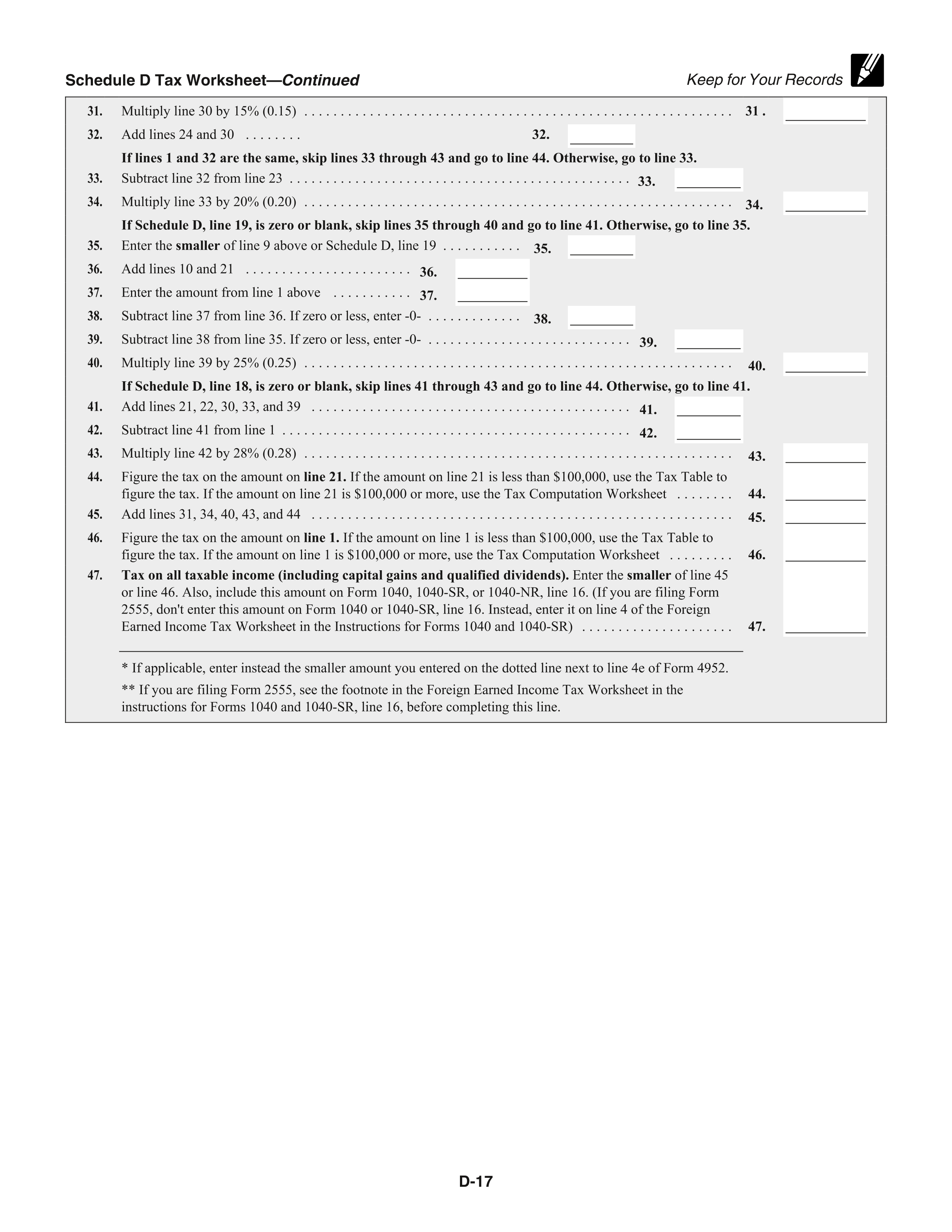

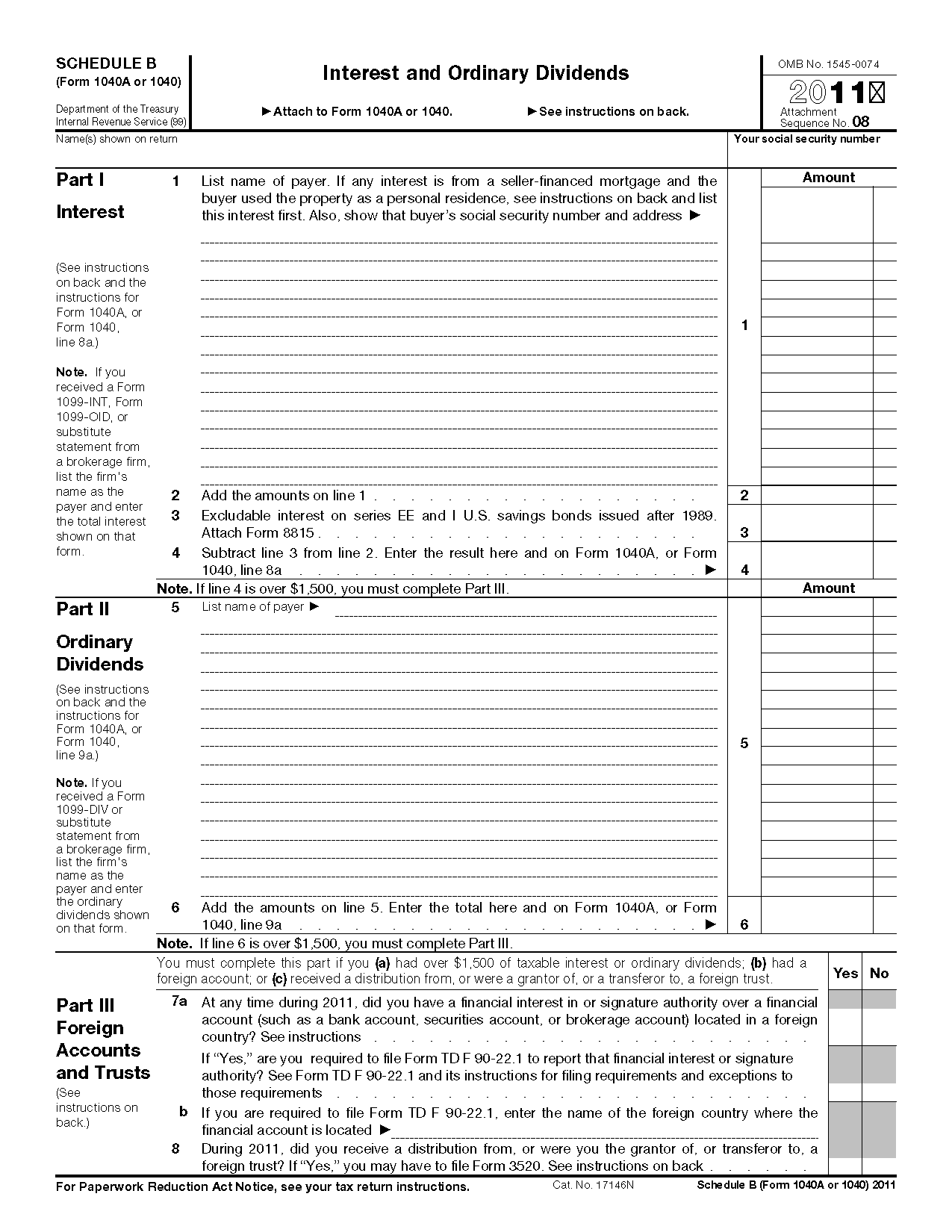

2025 Irs Schedule D Instructions - 2025 Irs Schedule D Instructions. Schedule d (form 1040) is a tax schedule from the irs that attaches to the form 1040, u.s. To report a gain from form 6252 or part i of form 4797. IRS Schedule D Instructions Capital Gains And Losses, Irs schedule d (1040) is broken up into three main parts, with each being labeled.

2025 Irs Schedule D Instructions. Schedule d (form 1040) is a tax schedule from the irs that attaches to the form 1040, u.s. To report a gain from form 6252 or part i of form 4797.

:max_bytes(150000):strip_icc()/ScheduleD-CapitalGainsandLosses-1-d651471c24974ac79739e2ef580b1c35.png)

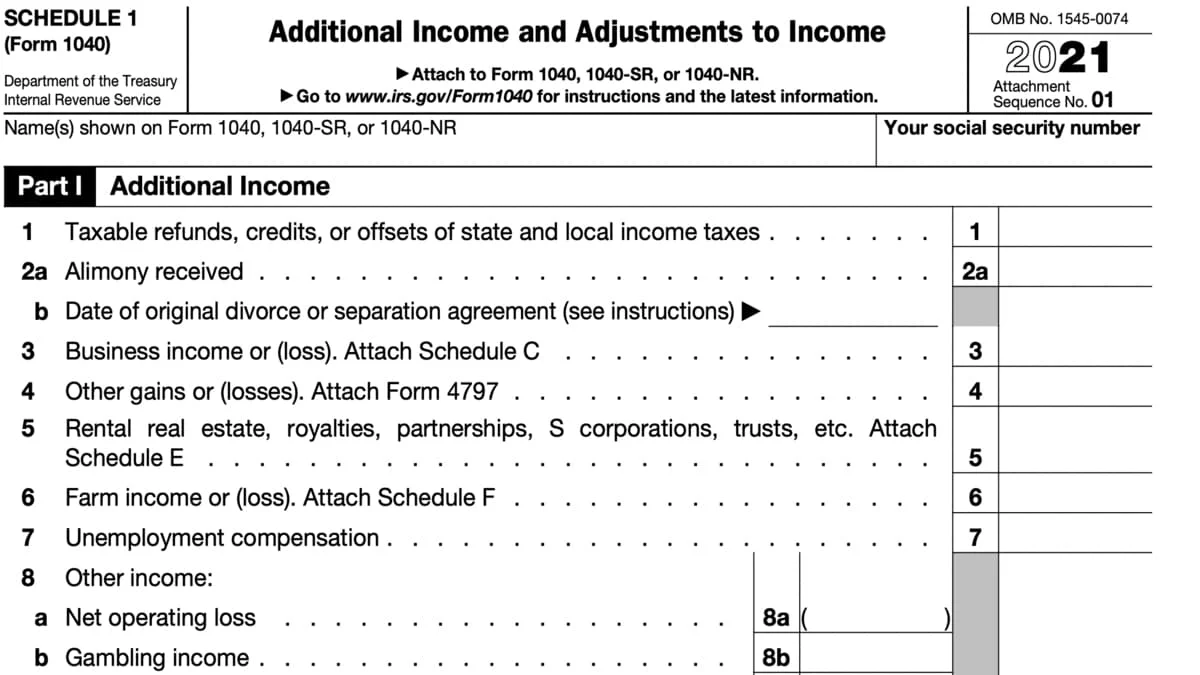

Florida Tax Free 2025 Schedule 1 Molly Lewis, A handful of tax provisions, including the standard deduction and tax brackets, will see new limits and.

2025 Instructions For Schedule D Sam Leslie, Learn how to report capital gains and losses on tax form 1040 schedule d with the irs.

Form Schedule D (Form 1040) For 2025 A Comprehensive Guide Cruise, These instructions explain how to complete schedule d (form 1041).

Irs Form 1040 Schedule D Instructions 2025 Form Emera Imojean, In this article, we’ll help you understand irs schedule d, specifically:

Personalized Babys First Christmas Ornament 2025. Celebrate your little one with a personalized baby's 1st […]

2025 Irs Form 941 Schedule B Alanna Salaidh, Washington — as the nation's tax season approaches, the internal revenue service is reminding people of simple steps they can take now to prepare to.

22, 2025, the irs announced the annual inflation adjustments for 2025. Use schedule d (form 1065) to report the following.

IRS Schedule D Instructions Capital Gains And Losses, To report a gain from form 6252 or part i of form 4797.

How to Complete IRS Schedule D (Form 1040), How to complete irs schedule d;

Irs Schedule D Instructions 2025 Casi, Capital assets include personal items like stocks, bonds, homes, cars, artwork, collectibles, and cryptocurrency.